Lake County Campus

Welcome to the Lake County Campus! We are proud to serve students and communities throughout Lake County.

(707) 995-7900

15880 Dam Road Extension

Clearlake, CA 95422

Email Lake County Campus

Additional Phone Numbers

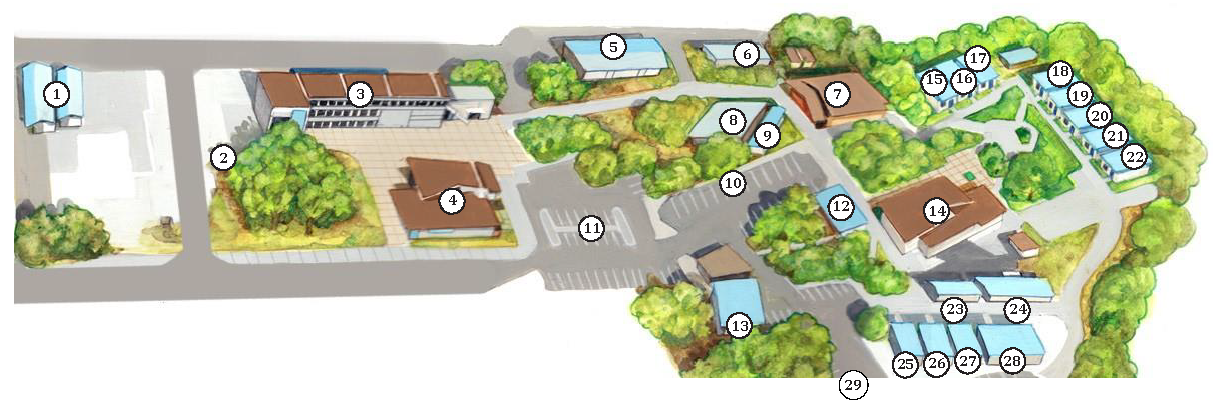

View Campus Map

Instagram

Facebook

Earn a Degree or Transfer

Associate degrees at LCC

- Accounting

- Administration of Justice

- Anthropology

- Biology

- Business

- Business Administration

- Business Information Professional

- General Business Management

- Business Management

- Chemical Dependency Counselor

- Culinary Arts

- Drinking Water & Waste Water Technology

- Early Childhood Education

- Economics

- English

- History

- Interdisciplinary Studies

- Arts & Humanities

- Child and Adolescent Development

- Law, Public Policy & Society

- Natural Sciences

- Pre-Health Occupations

- Social & Behavioral Sciences

- Human Services

- Nutrition & Dietetics

- Political Science

- Psychology

- Sociology

Adult Education

Non-credit courses & Certificates AT LCC

Get Job Training

Career Education Certificates AT LCC

- Accounting

- Business

- Business Information Worker–Administrative Assistant

- Business Information Worker–Clerical

- Business Management

- Entrepreneurship

- Medical Office Specialist

- Culinary Arts

- Baking

- Culinary Arts

- Chemical Dependency Counselor

- Drinking Water & Waste Water Technology

- Early Childhood Education

- Child Development Associate Teacher

- Child Development Master Teacher

- Child Development Teacher

- Infant & Toddler

- School Age Children

- Welding

- Welding Technologies

- Advanced Welding Technologies

Student Services at Lake County Campus

We offer a wide variety of support services to students at the LCC campus and remotely from the Woodland Main Campus.

Fall 2023 Service Hours:

Monday –Friday: 8:00am-5:00pm

Announcement: The Eagles' Basic Needs Center is now open Monday-Thursday from 10am-4pm. We are located on campus in the 800 Classroom Building. The center is available with free resources like personal care items, instructional supplies, food, snacks, some clothing items, and many other services!

Admissions

Learn More

Adult Education

Learn More

Bookstore (Online Only)

Learn More

CalWORKs

Learn More

Career Center

Learn More

Childcare

Learn More

Counseling

Learn More

Disability Support

Learn More

EOPS & CARE

Learn More

Financial Aid

Learn More

Food Pantry & Basic Needs

Learn More

Health Services

Learn More

High School Equivalency

Learn More

Library

Learn More

Success Center

Learn More

Transfer Center

Learn More

Veteran's Center

Learn More